As the saying goes, ‘If it sounds too good to be true, it probably is,’ and this couldn’t be more applicable than to the story of Charles Ponzi. You’re likely familiar with his name, synonymous with the fraudulent investment scheme that promised astronomical returns but was destined to collapse.

Born in Italy and arriving in America with dreams of riches, Ponzi’s journey from a hopeful immigrant to the mastermind behind one of the most notorious scams in history is a compelling tale of ambition, deception, and downfall.

Discover why his legacy is a stark reminder of the dangers lurking in seemingly lucrative opportunities. What lessons can you learn from his misadventures that are still relevant today?

Early Life and Education

Charles Ponzi, born in Lugo, Italy, in 1882, ventured to the United States in 1903 after an incomplete education at Sapienza University in Rome. His journey from Italy to the U.S. was marked by ambition, though initially not in the way you’d expect. Before he became synonymous with one of the most infamous financial fraud schemes, Ponzi’s early life and education seemed ordinary, if not tinged with hints of his future endeavors.

Growing up in Lugo, Ponzi’s aspirations pushed him towards higher education in Rome. Yet, Sapienza University didn’t hold him for long. He left without a degree, a decision that pivoted him towards a new path in America. It’s here that Ponzi’s story takes a turn. Initially, his jobs as a bank teller and insurance salesman were far from the criminal world. However, these roles might’ve been the first steps towards his later fraudulent schemes.

Ponzi’s early life in Italy and incomplete education were the prelude to a life filled with ambitious and, ultimately, criminal endeavors. His shift from a hopeful student to engaging in financial fraud schemes highlights a journey marked by complexity and a departure from the ordinary.

Journey to America

Stepping onto American soil in 1903, Ponzi harbored dreams of wealth, unaware of the infamous path his pursuit would take. Having immigrated to America with barely a penny to his name, he found himself in Boston, where the reality of his situation quickly set in. To survive, Ponzi took on various odd jobs, each one a far cry from the fortune he envisioned. These early struggles in the United States weren’t just about making ends meet; they were the foundation of his relentless pursuit of wealth.

This pivotal moment of moving to America marked the beginning of a journey fraught with both successes and failures. Ponzi’s experiences, from the menial work to the constant financial insecurity, shaped his mindset. They instilled in him a determination that would later become synonymous with some of the most fraudulent schemes in financial history.

Ponzi’s arrival and early years in America were more than just a struggle for survival; they were a prelude to his infamous career. Each job, each setback, was a stepping stone, leading him closer to the nefarious path that would eventually define his legacy in the United States.

The Montreal Chapter

In Montreal, Ponzi’s ambitions escalated as he masterminded a scheme promising investors a 200% return by investing in non-existent Rio de Janeiro land parcels. You’d be lured by the prospect of doubling your money through what seemed like lucrative land deals. But as you’d soon find out, these investments were based on false claims, leading to considerable financial losses.

The Montreal chapter not only expanded Ponzi’s fraudulent activities but also piled on more legal troubles. The promise of 200% returns in just 60 days attracted a significant amount of investments, all resting on the shaky foundation of Ponzi’s notoriety. Here’s how the scheme unfolded:

| Aspect | Description | Outcome |

|---|---|---|

| Land Deals | Promised lucrative returns on Rio land | Non-existent parcels |

| 200% Returns | Promised in 60 days | Based on false claims |

| Legal Troubles | Activities led to legal scrutiny | Increased Ponzi’s notoriety |

| Unraveling | Scheme’s exposure led to financial losses | Contributed to Ponzi’s downfall |

As the Montreal chapter added to the unraveling of Ponzi’s elaborate web of lies, investors were left grappling with the harsh reality of their financial losses, marking a pivotal moment in the infamous saga of fraudulent schemes.

Boston Experiences

After his dubious ventures in Montreal, Ponzi brought his fraudulent operations to Boston in 1919, promising high returns that would soon lead to his downfall. Setting up shop next to Boston’s City Hall, Charles Ponzi launched an investment scheme that quickly caught the city’s attention. You might imagine the bustling streets of Boston, filled with hopeful investors, all flocking to Ponzi’s office, eager to partake in what seemed like a once-in-a-lifetime opportunity.

In Boston, Ponzi’s strategy relied on a cycle of deception, using funds from new investors to pay earlier ones, creating an illusion of profitability. This unsustainable model was destined for financial insolvency. As word of these lucrative returns spread, more and more people were drawn in, unaware of the fraudulent activities behind Ponzi’s promises.

However, this charade couldn’t last forever. Government auditors in Boston stepped in, their investigations uncovering the harsh truth of Ponzi’s financial fraud. This intervention exposed the shaky foundations of Ponzi’s scheme, leading to a cascade of legal troubles. Boston’s backdrop became synonymous with one of the most infamous chapters in the history of financial fraud, marking the beginning of the end for Charles Ponzi’s nefarious operations.

The IRC Scheme Concept

At the heart of Charles Ponzi’s operation lay a clever manipulation of International Reply Coupons (IRCs), where he capitalized on post-World War I currency discrepancies to promise investors unprecedented returns. You’d be fascinated to learn how Ponzi promised high returns by exploiting the price differences of IRCs across different countries. This was the essence of the IRC scheme, a concept that revolved around buying IRCs at a discounted rate in one country and redeeming them at a higher value in another, generating profits.

Here’s a quick look at how the scheme worked:

| Aspect | Description |

|---|---|

| Core Idea | Buy low in one country, sell high in another |

| Promise to Investors | Quick wealth through high returns |

| Outcome | Rapid growth and eventual financial collapse |

Ponzi’s success with the IRC scheme wasn’t just about the currency exchange rates; it was also a testament to his ability to attract thousands of investors with the lure of easy wealth. However, beneath the surface of quick riches, the scheme’s unsustainable nature led to fraudulent activities and, ultimately, a dramatic financial collapse.

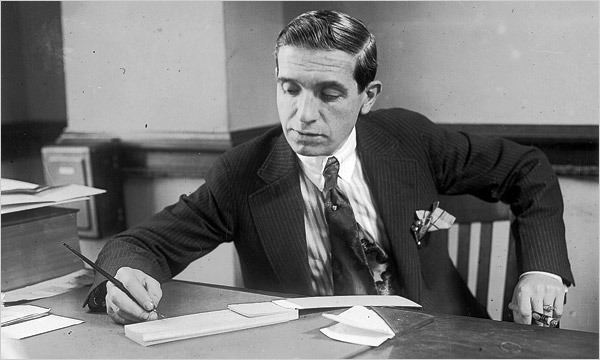

Securities Exchange Company

Charles Ponzi founded the Securities Exchange Company in January 1920, marking the beginning of one of history’s most infamous financial scams. By June 1920, this venture attracted investments totaling $2.5 million, a staggering amount for the time. Investors were drawn to Ponzi’s promise of high returns through a scheme involving postal reply coupons. However, Ponzi struggled with the feasibility of the scheme and faced significant challenges in converting postal reply coupons to cash.

Operating under the guise of the Securities Exchange Company, Ponzi lived a lavish lifestyle, owning multiple accounts and businesses. This facade of success and wealth was essential in maintaining investor confidence in the scheme. Unfortunately, the reality was far from sustainable. The complexity of cash conversion and the inherent flaws in Ponzi’s plan eventually led to the collapse of the Securities Exchange Company.

This collapse resulted in significant financial losses for the investors who’d put their trust and money into Ponzi’s scheme. The downfall of the Securities Exchange Company serves as a cautionary tale about the dangers of seemingly too-good-to-be-true investment opportunities.

Unraveling the Scheme

How did the once-thriving Ponzi scheme come to a sudden and catastrophic end? It all began in 1920 when investigations uncovered glaring discrepancies in Ponzi’s financial operations. The government stepped in, auditors dove deep, and what they found was shocking. Ponzi’s scheme, teetering on the edge of insolvency, crumbled, revealing the fraudulent foundation it was built on.

| Aspect | Detail | Impact |

|---|---|---|

| Investigations | Discrepancies found | Collapse of the scheme |

| Government Role | Auditors intervened | Exposed insolvency |

| Outcome | Scheme collapsed | Financial ruin for many |

| Ponzi’s Actions | Engaged in fraud in Florida, faced deportation | Legal consequences, prison time |

Despite facing federal charges of mail fraud and the looming shadow of legal consequences, Ponzi’s audacity didn’t wane. He ventured into another fraudulent scheme in Florida, only to find himself once again on the wrong side of the law, culminating in his deportation. The unraveling of the Ponzi scheme wasn’t just the downfall of a man but a stark warning of the dangers of fraudulent investment schemes, leaving many in financial despair and Ponzi with prison time to reflect on his actions.

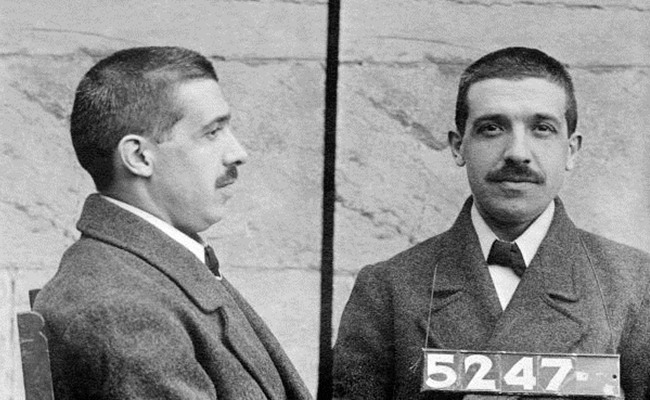

Legal Repercussions

Following the collapse of his fraudulent scheme, Ponzi’s legal battles began, marking a significant chapter in the saga of his downfall. You’d find the courtroom became a familiar place for him as he faced a multitude of legal challenges.

- He initially faced 86 counts of mail fraud but chose to plead guilty to one count in his legal battle, highlighting the vast reach of his fraudulent activities.

- His sentence to 5 years in federal prison was just the beginning, as state charges of larceny soon added to his woes.

- Ponzi’s attempt to fight these additional charges through a lawsuit against double jeopardy failed, showing his desperation to avoid further punishment.

- The legal battles didn’t stop there; his involvement in a new scheme in Florida led to more indictments.

- Eventually, these continued legal troubles culminated in his deportation to Italy, putting an end to his notorious career in America.

Each point underscores the relentless nature of Ponzi’s legal repercussions, as he went from one legal battle to another, unable to escape the consequences of his actions. His story serves as a stark reminder of the legal consequences that follow fraudulent activities.

Final Years and Legacy

In his final years, Ponzi lived in poverty and declining health, ultimately dying nearly broke in Rio de Janeiro on January 18, 1949. After being deported from the United States, his life in Italy and Brazil was a far cry from his days of lavish living fueled by financial deceit. Despite the initial allure of easy profits, Ponzi’s end serves as a stark reminder of the fleeting nature of wealth obtained through financial fraud.

Ponzi’s legacy is undeniably a cautionary tale, warning of the dire consequences that follow such fraudulent activities. The collapse of his scheme led to significant financial losses for many investors, showcasing the devastating impact of such deceit. His story, extensively documented in publications and documentaries, continues to fascinate and serve as a lesson on the perils of greed and the importance of ethical investing.

Though Ponzi’s name is now synonymous with financial fraud, his life underscores the importance of vigilance in the financial sector. His schemes, while initially successful, ultimately highlight the inevitable downfall that accompanies deceit and manipulation in the pursuit of wealth.

Conclusion

You’ve now delved into the life of Charles Ponzi, a man whose quest for wealth led him down a notorious path. From his early struggles to the grandiose scheme that bears his name, Ponzi’s story is a stark reminder of the perils of greed and the consequences of fraud.

His legacy, marked by legal woes and eventual downfall, serves as a cautionary tale, urging us to tread carefully in the financial world and to question promises of easy riches.